|

Guidance for Coronavirus-Related Distributions and Loans from

The CARES Act was enacted on March 27 2020 Under section 2202 of the CARES Act qualified individuals receive favorable tax treatment with respect to distributions from eligible retirement plans that are coronavirus-related distributions |

What happens when you take out a 401(k) loan in 2020?

And when IRS rules go back to normal, you’re not even allowed to put the money you took out back into your retirement account.) The CARES Act gives you an extra year to pay off your loan, for a total of six years if you take out a loan in 2020. The legislation also extends the repayment deadline on existing 401 (k) loans by one year.

What are the 401(k) loan terms under the CARES Act?

Under the CARES Act, a 401 (k) plan can offer special loan terms to participants that meet one of the CRD conditions. For new loans requested between March 27, 2020 and September 23, 2020. Eligible participants can receive 100% of their vested account balance up to $100,000 – instead of the normal 50% up to $50,000 limit.

When do special rules apply to a cares loan?

Special rules apply to a loan made from a qualified employer plan (as defined in § 1.72(p)-1, Q&A-2) to a qualified individual on or after March 27, 2020 (the date of enactment of the CARES Act) and before September 23, 2020. For these loans, section 2202(b)(1) of the CARES Act changes the limits under 72(p)(2)(A) of the Code.

Are CARES Act 401(k) withdrawals a good idea?

CARES act 401 (k) withdrawals are beneficial for people who have lost their income because of the coronavirus and are not in a position to make further contributions. For many, however, there is still more work that needs to be done before they can continue with their retirement plans.

Coronavirus-Related Distributions

Under the CARES Act, a 401(k) plan can offer “Coronavirus-related Distributions” (CRDs) to participants that meet one or more of the following conditions: 1. The participant is diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention, 2. The participant's sp

Coronavirus-Related Loans

Under the CARES Act, a 401(k) plan can offer special loan terms to participants that meet one of the CRD conditions. 1. For new loans requested between March 27, 2020 and September 23, 2020. 1.1. Eligible participants can receive 100% of their vested account balance up to $100,000 – instead of the normal 50% up to $50,000 limit. 1.2. If a plan does

Required Minimum Distributions

Under the CARES Act, a 401(k) plan can allow any participant – regardless of whether they meet one of the three CRD conditions or not – to waive their Required Minimum Distribution (RMD) during 2020. If a plan adopts the CARES Act RMD provisions: 1. Eligible individuals include: 1) participants who are 72 or older in 2020, 2) participants who turne

Adopting Cares Act 401(k) Provisions

While employers can begin operating their 401(k) plan under the CARES Act provisions immediately, I generally recommend they hold off on doing so until a participant requests CARES Act relief. The reason - adopting CARES Act provisions in operation will require new participant forms and a formal plan amendment down the road. If the CARES Act provis

Don’T Lose Sight of The Future

No doubt about it – COVID-19 has hit many individuals hard. Many have lost their job or working fewer hours. However, taking a CARES Act distribution or loan should be a last resort for 401(k) participants because the long-term consequences for doing so can be severe: 1. The value of most 401(k) investments has dropped a lot due to the COVID-19 cri

|

Guidance for Coronavirus-Related Distributions and Loans from

Section 2202 of the CARES Act also increases the allowable plan loan amount Section 401(k)(2)(B)(i) generally provides that amounts attributable to. |

|

Legally Brief: COVID-19 UPDATE THE CARES ACT: 401K LOAN

THE CARES ACT: 401K LOAN EXPANSION AND STUDENT LOAN RELIEF. The $2 trillion CARES Act the economic stimulus package recently signed into law |

|

CARES ACT 401(k) LOAN PAYMENT DEFERMENTS ATTN: Fidelity

ATTN: Fidelity 401(k) Participants that elected a CARES Act 401(k) loan deferment. In October 2020 Fidelity will be sending a reminder to applicable plan |

|

Recontribution of CARES Act Distribution(s) (Rollover Contribution

(Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans Under the CARES Act) and consult with your tax advisor for further |

|

How the CARES Act impacts retirement plan account access

provisions in the CARES Act allow companies to provide employees expanded Loan: When you take a loan from your 401(k) account the money you borrow ... |

|

The CARES Act: Selected Data on Coronavirus-Related Distribution

13 juil. 2021 The CARES Act: Select Data on CRD and Loan Usage in 2020 ... advantages for retirement savings plans such as 401(k) plans and individual ... |

|

Voya Updates on the CARES Act

The Coronavirus Aid Relief |

|

Notice 2020-50 PDF - Internal Revenue Service

281 (2020) (CARES Act) for qualified individuals and eligible retirement plans Section 2202 of the CARES Act also increases the allowable plan loan amount |

|

CARES ACT 401(k) LOAN PAYMENT DEFERMENTS ATTN: Fidelity

ATTN: Fidelity 401(k) Participants that elected a CARES Act 401(k) loan deferment In October 2020 and elected to defer their 401(k) loan payments (as allowed by the CARES Act), that this loan payment deferral will end www 401k com |

|

Understanding the CARES Act and what it means for you - NCPlans

26 mai 2020 · delay loan payments and extend the term of the loan for one year o This is OPTIONAL and you must let Prudential Retirement® know if you wish |

|

COVID-19, the CARES Act and your retirement plan - ADP

be sent to ADP 401k with the next payroll file transmission The C A R E S Act provides special loan suspension ability for participants who are adversely |

|

CARES Act Brings Immediate Changes for 401(k) - Groom Law Group

15 avr 2020 · Loan Suspension Suspension of loan payment due March 27, 2020 through December 31, 2020 for up to one year • RMD Relief Suspension of |

|

401(k) Withdrawal and Loan FAQs - Walmart One

Withdrawal and Loan 401(k) FAQs 042120A All regular withdrawal and loans options are still available if you don't qualify for the CARES Act relief 7 How do |

|

CARES Act Offers Economic Relief to Employees - Twenty Over Ten

The CARES Act includes provisions applicable to retirement plans including loan distributions, withdrawals and required minimum distributions (RMDs) |

|

CARES Act and Economic Condition FAQs - Newport Group

8 avr 2020 · Do the CARES Act loan provisions apply to Roth 401k accounts? Yes, the loan provisions apply to qualified plans (including Roth 401(k), 403(b) |

|

Updates to the CARES Act and relief through your Deferred Salary

1 sept 2020 · Security Act (CARES Act)—and expanded eligibility for early o You can take out a loan of up to $100,000 or 100 of your vested balance Usually opportunity, you must contact Prudential at 877-JIB-401k (877-542-4015) |

| CARES Act Provisions |

|

[PDF] How the CARES Act impacts retirement plan account access - BNSF

provisions in the CARES Act allow companies to provide employees Loan When you take a loan from your 401(k) account, the money you borrow loses its |

|

[PDF] CARES Act Brings Immediate Changes for 401(k) Plans

Apr 15, 2020 · Increase in the loan limit under Code section 72(p) from $50,000 to $100,000 (or 100 of the participant's account balance, if less) for loans |

|

[PDF] Guidance for Coronavirus-Related Distributions and Loans from

Section 2202 of the CARES Act also increases the allowable plan loan amount Section 401(k)(2)(B)(i) generally provides that amounts attributable to elective |

|

[PDF] The Coronavirus Aid, Relief and Economic Security (“CARES”) Act

Have 401(k) loan limits been adjusted? Yes If allowed by the plan, the loan limit can be increased to the lesser of $100,000 or 90 of the participant's vested |

|

[PDF] CARES Act - Congressgov

Economic Security Act'' or the ''CARES Act'' SEC 2 Institutional refunds and Federal student loan flexibility Sec 3509 Temporary relief for federal student loan borrowers Sec of sections 401(k)(2)(B)(i), 403(b)(7)(A)(i), 403(b)(11), and |

|

[PDF] (CARES) Act: Increasing Loan Limits Service - Fidelity Investments

Apr 14, 2020 · The CARES Act includes an optional change related to plan loans, as described in Section 2202 of the CARES Act, available for 401(a), 401(k), |

|

[PDF] CARES Act and delay of loan repayments service - Fidelity

Apr 14, 2020 · described in Section 2202 of the CARES Act, available for 401(a), 401(k), 403(b) and governmental 457(b) plans (individually, a “Plan) |

|

[PDF] Voya Updates on the CARES Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a distributions”, or CRDs) and higher loan amounts from qualified retirement accounts Plan,” (an IRA, 401(a) plan (including a 401(k) plan), 403(b) plan, or governmental |

- cares act 401k loan deferment

- cares act 401k loan payment deferment

- 401k cares act 2020

- cares act 401k loan suspension

- cares act 401k deadline

- cares act 401k changes

- changes to 401k loans

- cares act 401k withdrawal

- 401k loan cares act rules

- 401k loan cares act irs

- 401k loan cares act reddit

- 401k loan cares act interest

- 401k loan cares act fidelity

- 401k loan deferment cares act

- 401k loan repayment cares act

- 401k loan under cares act

Wells Fargo 401k Loan - Fill Online Printable Fillable Blank

Source:https://www.kitces.com/wp-content/uploads/2020/03/Key-2020-CARES-Act-Provisions-040220.png

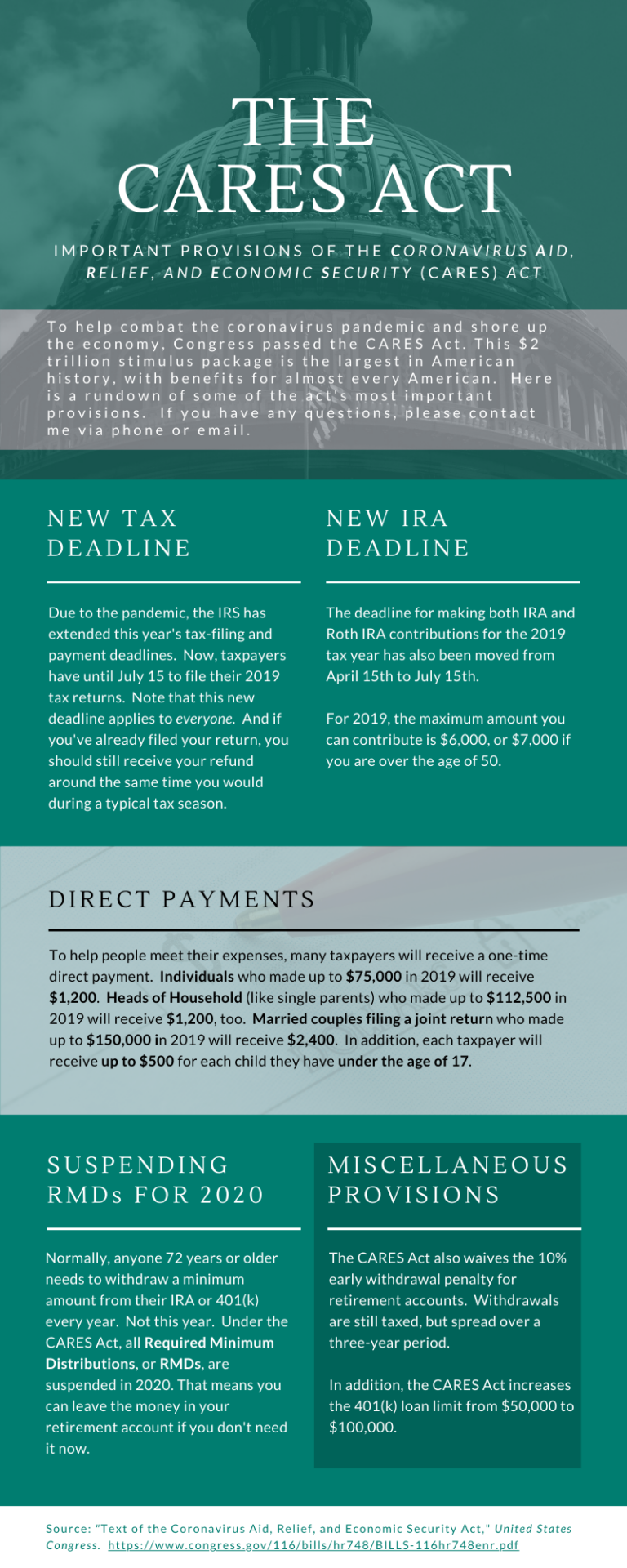

CARES Act Provisions For Financial Advisors And Their Clients

Source:https://www.mmwealth.com/wp-content/uploads/2020/04/CARES-Act-Infographic-PNG.png

CARES Act Infographic - Financial Advisors offering Portfolio

Source:https://www.pdffiller.com/preview/0/157/157802/large.png

Prudential 401k Withdrawal Form - Fill Online Printable Fillable

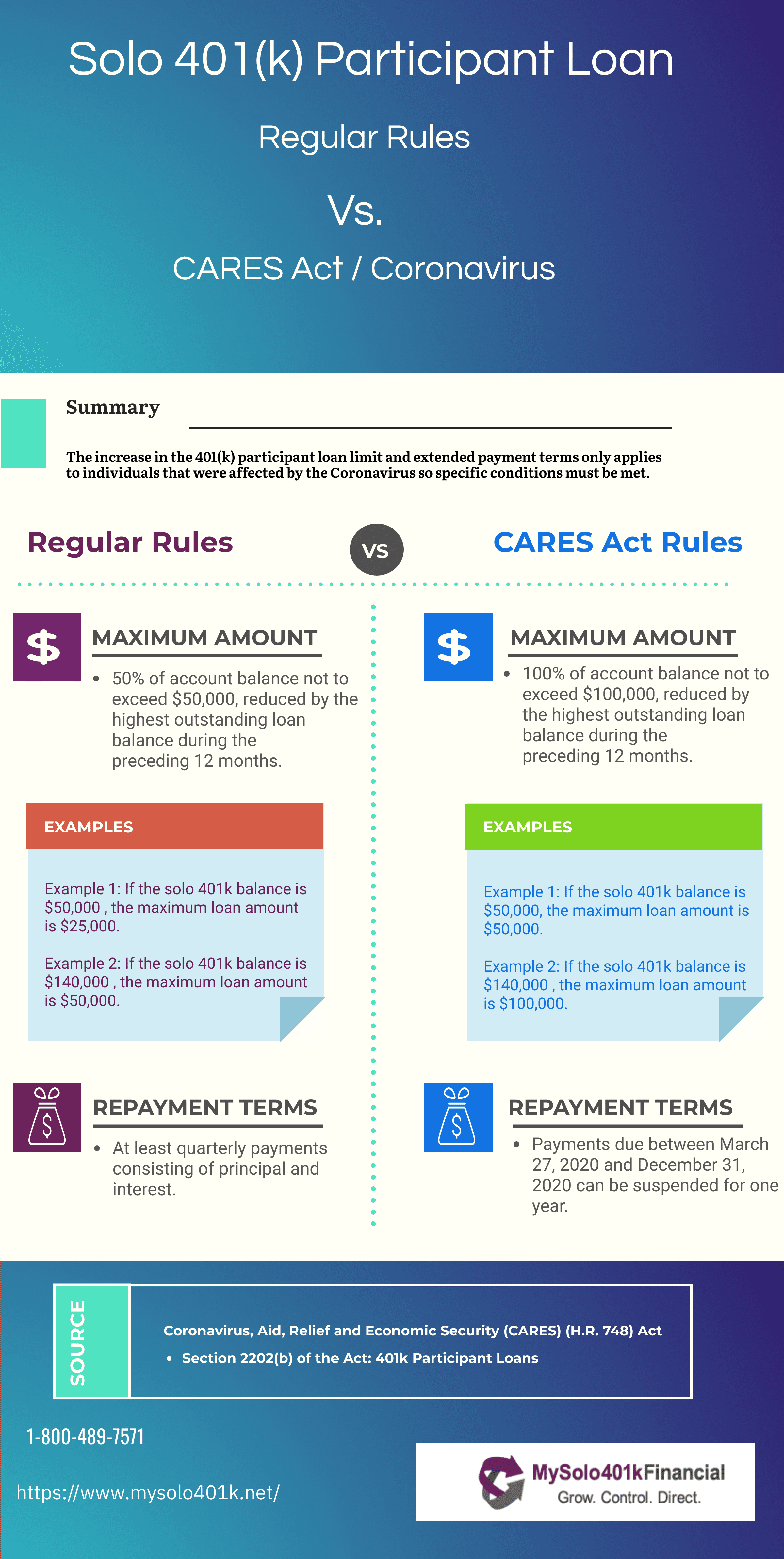

Source:https://www.mysolo401k.net/wp-content/uploads/2020/04/401k-Loans-pre-CARES-and-After-CARES.png

Solo 401k FAQs Surrounding Coronavirus Aid Relief and Economic

Source:https://www.signnow.com/preview/0/157/157802.png

Prudential 401K Withdrawal Form - Fill Out and Sign Printable PDF

Source:https://www.nagdca.org/wp-content/uploads/2020/04/NAGDCA-CARES-Act-Analysis_image.jpg

401k loan coronavirus

[PDF] Coronavirus Relief: What You Need to Know - T Rowe Price

- 401k loan coronavirus fidelity

- 401k loan coronavirus rules

- 401k loan covid rules

- 401k loan covid vanguard

- walmart 401k loan coronavirus

- 401k covid loan requirements

- 401k covid loan fidelity

401k loan covid

[PDF] COVID-19 FAQs for Participants and Beneficiaries - United States

- 401k loan covid vanguard

- 401k covid loan requirements

- 401k covid loan fidelity

- 401k loan coronavirus rules

- 401k loan during covid

- 401k loan withdrawal covid

- 401k loan payback covid

- irs 401k loan covid

401k loan regulations

[PDF] Loans from Tax Qualified Retirement Plans

- erisa 401k loan regulations

- dol 401k loan regulations

- irs 401k loan regulations

- 401k plan loan regulations

- new 401k loan regulations

401k loan repayment calculator

[PDF] Loan Guidelines - Prudential Retirement - Prudential Financial

- loan calculator

- merrill lynch 401k loan early payoff

- merrill lynch 401k loan payoff

- 401k loan repayment rules

- merrill lynch 401k loan processing time

- merrill lynch 401k loan calculator

- icma loan repayment

- icma-rc loan interest rate

- 401k loan repayment calculator t rowe price

- 401k loan repayment calculator fidelity

- 401k loan repayment calculator prudential

- 401k loan repayment calculator biweekly

- 401k loan repayment calculator weekly

- 401k loan repayment calculator wells fargo

- 401k loan payment calculator

- 401k loan payment calculator weekly